Fundraising Workshop Series

FOC Accelerator runs a series of Fundraising Workshops that explain the nuances of creating and managing an effective outbound fundraising campaign. The content is tailored towards emerging and experienced scientist-entrepreneurs seeking to raise capital. The topics include an overview of today’s investor landscape (i.e. the VC void and new investor categories filling that void), branding and messaging, the philosophy of an outbound fundraising campaign, generating a global target list, and managing mailings, follow-up and meetings.

Marketing, Writing Style & Campaign Content

Marketing is about more than the content – it’s about how you write, and how it speaks to your target audience. One of the biggest pieces of advice we can give companies is to know your audience. This session covers how to tailor your language to the different players you will speak to within investor and partner firms, and how to spread your message effectively to your target audience.

Tech Hub Exposure at RESI

This webinar is designed for tech hub organizations ranging from accelerators, incubators, non-profits, universities, tech transfer offices, regional organizations, and more who set up their early-stage life science startup constituents for success with their entrepreneurship and fundraising journey. It will showcase the tools and resources that LSN makes available for Tech Hubs to help their startups who’ve raised less than $2M USD in capital expand their outreach from Regional to Global, build a target list of investors, get involved with the RESI conference series, and more.

Workshop Video

It All Starts with A Story

The most successful entrepreneurs are always the best storytellers. Finding a way to naturally formulate your company’s unique story and portraying this through multiple modalities whether it be a 1-minute elevator pitch or a 12-slide pitch deck is one of the most effective ways to get potential investors and partners on board with your value proposition. This boot camp will cover the importance of entrepreneurial agency, finding your voice and developing a compelling narrative for the different players that will emerge along a deal chain, and language tools to refine your hook.

Workshop Video

Launching Your Startup

Launching a startup begins with commitment. Commitment to your startup initiative, your executive team, and your partners. Learn how to sustain this commitment by creating a proof of concept or prototype and create market traction initially, considerations to your corporate structure, simplifying finances in the beginning, and what tools to utilize. This presentation walks you through an honest look at best practices to launch a life science startup.

Workshop Video

First-Time CEOs: Avoiding Pitfalls and Staying in Context

This session covers some of the most common pitfalls that catch first-time and serial entrepreneurs off guard. From false premise and being tentative to surrounding yourself with executives that do not have augmentative and complimentary skillsets, there are many things that can slow the growth of your early-stage life science entity. By learning how to avoid these issues and not run yourself over, your chances of making it to the market will increase greatly.

Workshop Video

Strategies for Successful Partnering

Take a deep dive into your outreach campaign. Learn more about our proven successful strategy and how to craft your messages from your initial outreach and each follow up message after that.

This workshop will be hosted by Alexander Vassallo, BD Manager of West Coast USA and Joey Wong, Senior Investor Research Analyst, and Hong Kong BD.

Workshop Video

Tagline & Elevator Pitch

Distilling your company identity into a 5-7 word tagline and then expanding upon that in a 5-7 sentence elevator pitch is one of the most fundamental business development skills that early-stage entrepreneurs must master when launching global partnering campaigns. Join us to learn how to develop a compelling tagline and convincing elevator pitch to grip the attention of your target investors and licensing partners.

This webinar will be hosted by Claire Jeong, VP of Investor Research and Japan & Korea BD, and Antoinette Lowre, BD Manager of Midwest USA & Canada.

Workshop Video

Tech Hub Exposure at RESI

This webinar is designed for tech hub organizations ranging from accelerators, incubators, non-profits, universities, tech transfer offices, regional organizations, and more who set up their early-stage life science startup constituents for success with their entrepreneurship and fundraising journey. It will showcase the tools and resources that LSN makes available for Tech Hubs to help their startups who’ve raised less than $2M USD in capital expand their outreach from Regional to Global, build a target list of investors, get involved with the RESI conference series, and more.

Workshop Video

Early Stage Fundraising 101: Delivering a Successful Virtual Pitch

The Innovator’s Pitch Challenge (IPC) returns across the upcoming 3-day digital conference, Digital RESI, March 14-16th. Being able to successfully deliver a powerful and compelling pitch to portray why your company’s unique technology should be an investor’s top interest. This workshop gives you tips from the application process, execution of the pitch and preparing for investor-led Q&A.

This workshop will be hosted by Karen Deyo, Director of Investor Research and Israel BD, and Candice He, VP of Business Development.

Workshop Video

Preparing your Non-Confidential Materials for JPM

Showcasing your company at events like the Innovator’s Pitch Challenge is an excellent opportunity to get visibility with investors and strategics. This workshop gives you tips for Preparing your Non-Confidential Materials for JPM.

Workshop Video

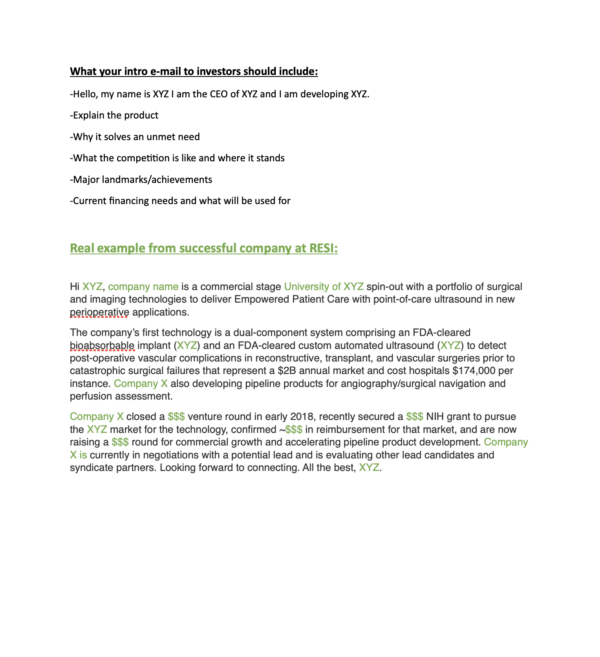

Outreach Template + Example

LSN Workshops at RESI Boston 2022

Supporting Tech Hub Startups at RESI

This workshop is designed for tech hub organizations ranging from accelerators, incubators, non-profits, universities, tech transfer offices, and regional organizations who set up their early-stage life science startup constituents for success with their entrepreneurship and fundraising journey. It will showcase the tools and resources that LSN makes available for Tech Hubs to help their startup constituents who’ve raised less than $2M expand outreach from Regional to Global, build a target list of investors, and more.

Workshop Video

Fundraising Workshop: It All Starts With the Story

The most successful entrepreneurs are always the best storytellers. Finding a way to naturally formulate your company’s unique story and portraying this through multiple modalities whether it be a 1-minute elevator pitch or a 12-slide pitch deck is one of the most effective ways to get potential investors and partners on board with your value proposition. This bootcamp will cover the importance of entrepreneurial agency, finding your voice and developing a compelling narrative for the different players that will emerge along a deal chain, and language tools to refine your hook. Investors always bet on the team, not just the technology, and if every member of your startup can tell any strategic partner a consistent story of your company and technology, you are on the right track to building successful relationships.

Fundraising 101: Avoiding Pitfalls and Improving the Odds

This bootcamp is designed to help scientist-entrepreneurs navigate the world of fundraising. It starts out by debunking some commonly held misconceptions about early-stage startups and fundraising, followed by tips on how to improve your chances and increasing investor visibility.

Fundraising Boot Camp

The Fundraising Boot Camp provides a top-to-bottom master class on outbound global fundraising. Topics to be covered include the changing investor landscape, new categories of life science investors, and how to organize and execute a successful roadshow. It will bring you step-by-step through the processes of positioning, marketing collateral, website creation, branding & messaging, and how to reach out to a list of global investors

Workshop Video

Branding & Messaging

The Branding & Messaging workshop discusses how to brand you and your firm and how to provide potential investors with high-quality, professional collateral—materials that engage them, communicate your message clearly and concisely, and present the information they want to see in a way that helps them to decide quickly and easily if you are a potential fit for their needs.

Workshop Video

Researching Global Investors

The Researching Global Investor workshop provides the basics to create a global target list by doing research on your own. It discusses the best practices to increase precision and efficiency when identifying active investors based on fit for your opportunity. It also introduces fundraising executives to the 10 different investor types as well as provides tactical advice on how to identify the appropriate contact person and what to send in your initial outreach.

Building a Cloud Infrastructure

The Building a Cloud Infrastructure workshop discusses methods scientist-entrepreneurs use to regularly touch base with and manage a large group of qualified investor contacts, and how cloud-based tools can be utilized to monitor your progress and carry out an effective campaign. Fundraising is a numbers game, and the more opportunities you have to start a dialogue, the better you will perform. By setting up a software infrastructure to track and manage your campaign, you will increase your outreach efficiency and create a better chance of success.

Deal & Product Valuations

In this workshop, you will learn how to calculate and determine the right assumption for any therapeutic product (pre-clinical, clinical or on the market) to structure a suitable licensing deal. What deal terms can you ask for or what should be the equity share to a new investor? These are critical question for most life sciences companies. However, valuation is more than just numbers – it’s about the assumptions and about understanding the business, so it comes down to the potential of a product or company and the associated risk.

Speakers

Dennis Ford

Founder and CEO, Life Science Nation (LSN); Creator, Redefining Early Stage Investment (RESI) Conference Series, RESI AI Conference, and RESI Longevity Conference; Architect, Focus on Cures Accelerator; Member, SPIC/FINRA Advisory Firm

Dennis Ford is an entrepreneur and author with distinct expertise in sales, marketing, and business development. He has spent most of his career finding, vetting and launching a myriad of technology-based companies. Over the last decade, he has worked extensively with global alternative investors and is deeply interested in getting funding for high-growth early-stage technologies. He is a big proponent of using profiling and matching technology to find that all-important business fit in the marketing and selling process. In today’s context Dennis can connect early stage life science companies with 10 categories of global partners thus making the finding of capital and distribution channels very efficient.

Dennis created the Redefining Early Stage Investments conference series to facilitate an interactive ongoing dialog between buyers and sellers in the life science arena. Before LSN, Dennis was the President and CEO of a company that improved the way hedge fund and private equity fund managers raised capital and marketed their funds to investors. Ford is the author of The Peddler’s Prerogative and The Life Science Executive’s Fundraising Manifesto, two well-received sales and marketing books.

Claire (Chae-Kyeong) Jeong

VP of Investor Research, Asia Business Development, Life Science Nation

As VP of Investor Research and Asia BD at LSN, Claire is responsible for curating the LSN Investor Database and manages relationships with a wide network of investors and pharmaceuticals across the globe, including groups in South Korea and Japan, leveraging her global network. In addition, Claire is the team lead for the Innovation Challenge, a start-up competition organized during every RESI conference Claire graduated from Boston College with a Bachelor of Science Degree as a Biochemistry Major and Mathematics Minor.

Greg Mannix

VP of International Business Development, Life Science Nation

Greg Mannix is Vice President of International Business Development at Life Science Nation. After graduating from the University of California, he moved to Europe where he began a career in the life sciences and obtained a Master’s degree from IE Business School in Madrid. He has extensive experience in sales and marketing management in large medical device corporations and small start-ups alike, giving Greg a well-rounded international experience in the healthcare field. He has worked extensively in Europe, North America and Latin America and he speaks English, Spanish and French.

Greg relocated to Boston 6 years ago to set up the US affiliate for an early-stage Med-tech company from Spain and he immediately took to the vibrant startup community there. Working for LSN is a great way to stay involved in that exciting space.

Candice He

VP of Business Development, Global Investment Strategist, Life Science Nation

Candice leads the business development team at Life Science Nation and manages the relationship with the LSN entrepreneur community on the east coast USA and China. Working closely with other team leads at LSN, Candice is in charge of analyzing user experience to improve existing products and designing new programs for life science startups, service providers, and tech hubs. As the Global Investment Strategist, she is the lead in expanding the business to the Chinese market, and was the project manager for RESI Shanghai 2019, the first RESI Conference in Asia. Candice worked for Boston Angel Club after obtaining her Master of Science in Finance (MSF) from Brandeis University in Boston.

Karen Deyo

Director of Research, Israel Business Development, Life Science Nation

Karen Deyo is an Investor Research Analyst at Life Science Nation. In addition to her role curating the LSN Investor Database, she is actively involved in Israel BD, utilizing her professional and personal connections to connect LSN to the Israeli life sciences startup community. Karen has a Masters of Engineering in Biomedical Engineering as well as a Certificate in Graduate Business Study from Worcester Polytechnic Institute and a Bachelor of Science degree in Engineering with a concentration in Bioengineering from Olin College of Engineering.

Antoinette Lowre

Business Development Manager Mid-West (US) & Canada, Life Science Nation

Antoinette Lowre is the business development manager for the US Mid-West and Canada at Life Science Nation. Antoinette began her career in the life science industry in May of 2021 has enjoyed learning all there is about life sciences and making connections with her clients. Antoinette received her bachelor’s degree in Business Administration from Nichols College in 2017 with focuses in economics, finance and business communications.